All Categories

Featured

Table of Contents

Interest in single premium life insurance policy is mostly due to the tax-deferred treatment of the accumulation of its money values. Tax obligations will certainly be incurred on the gain, however, when you surrender the plan.

The benefit is that enhancements in rate of interest rates will be shown a lot more quickly in interest sensitive insurance policy than in traditional; the negative aspect, obviously, is that decreases in rate of interest will certainly additionally be felt quicker in interest delicate entire life. There are 4 standard rate of interest sensitive entire life policies: The global life policy is in fact greater than rate of interest delicate as it is developed to reflect the insurer's existing mortality and expense along with interest incomes instead than historic rates.

Is 30-year Level Term Life Insurance Right for You?

The firm credit ratings your premiums to the cash money worth account. Regularly the firm subtracts from the cash money worth account its expenditures and the expense of insurance security, typically described as the mortality reduction charge.

Existing assumptions are vital to rate of interest sensitive products such as Universal Life. Universal life is also the most versatile of all the different kinds of plans.

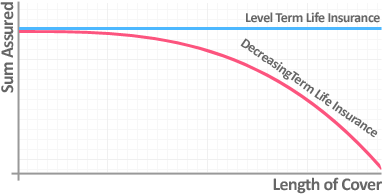

The plan generally offers you a choice to choose 1 or 2 sorts of survivor benefit - Level term life insurance policy. Under one option your beneficiaries obtained just the face quantity of the policy, under the other they receive both the face amount and the money worth account. If you want the optimum quantity of death advantage now, the 2nd choice needs to be selected

What is 30-year Level Term Life Insurance? Understand the Details

It is very important that these presumptions be practical due to the fact that if they are not, you might have to pay more to maintain the policy from decreasing or lapsing. On the other hand, if your experience is much better after that the assumptions, than you might be able in the future to avoid a costs, to pay less, or to have actually the strategy paid up at an early day.

On the other hand, if you pay even more, and your assumptions are realistic, it is feasible to pay up the policy at a very early day. If you give up an universal life plan you may obtain less than the money value account as a result of abandonment costs which can be of two types.

A back-end type plan would be better if you intend to keep coverage, and the charge lowers with yearly you continue the plan. Bear in mind that the rate of interest price and expenditure and death fees payables at first are not ensured for the life of the plan. Although this type of plan gives you maximum adaptability, you will certainly need to actively handle the policy to preserve adequate funding, particularly because the insurance policy business can enhance mortality and expense charges.

You might be asked to make added premium repayments where insurance coverage might terminate due to the fact that the interest price went down. The guaranteed rate provided for in the policy is a lot reduced (e.g., 4%).

You have to receive a certification of insurance defining the stipulations of the team policy and any type of insurance cost. Normally the optimum amount of coverage is $220,000 for a home mortgage loan and $55,000 for all various other financial obligations. Credit score life insurance policy need not be purchased from the company approving the car loan.

If life insurance policy is needed by a lender as a condition for making a lending, you may have the ability to appoint an existing life insurance policy policy, if you have one. You may wish to purchase group debt life insurance policy in spite of its greater cost because of its benefit and its accessibility, normally without detailed evidence of insurability.

What Are the Benefits of What Is A Level Term Life Insurance Policy?

Nonetheless, home collections are not made and costs are mailed by you to the representative or to the company. There are certain aspects that have a tendency to enhance the costs of debit insurance policy even more than regular life insurance policy plans: Particular expenditures coincide regardless of what the size of the plan, so that smaller plans released as debit insurance policy will certainly have higher costs per $1,000 of insurance than larger size routine insurance plan.

Because very early gaps are costly to a firm, the expenses have to be passed on to all debit insurance holders (Life insurance level term). Since debit insurance policy is created to include home collections, higher payments and charges are paid on debit insurance coverage than on normal insurance coverage. Oftentimes these greater costs are passed on to the insurance policy holder

Where a firm has different costs for debit and normal insurance it might be feasible for you to buy a bigger quantity of routine insurance than debit at no extra expense. Therefore, if you are thinking about debit insurance coverage, you must absolutely check out regular life insurance coverage as a cost-saving option.

This strategy is made for those who can not originally manage the normal whole life premium however who desire the greater costs coverage and feel they will become able to pay the greater premium. The household policy is a combination plan that offers insurance policy protection under one contract to all members of your immediate family members other half, better half and kids.

Joint Life and Survivor Insurance coverage gives protection for two or even more persons with the fatality benefit payable at the fatality of the last of the insureds. Costs are dramatically reduced under joint life and survivor insurance coverage than for policies that guarantee just one individual, considering that the probability of needing to pay a death case is reduced.

What is the Purpose of 20-year Level Term Life Insurance?

Costs are significantly greater than for policies that guarantee someone, because the likelihood of needing to pay a fatality case is greater. Endowment insurance coverage offers the payment of the face amount to your recipient if death takes place within a details duration of time such as twenty years, or, if at the end of the details period you are still to life, for the repayment of the face amount to you.

Juvenile insurance gives a minimum of defense and can offer insurance coverage, which may not be available at a later date. Quantities offered under such protection are typically limited based upon the age of the kid. The existing constraints for minors under the age of 14.5 would certainly be the higher of $50,000 or 50% of the amount of life insurance policy effective upon the life of the candidate.

Juvenile insurance coverage might be offered with a payor benefit cyclist, which attends to forgoing future costs on the child's plan in the event of the fatality of the individual that pays the costs. Senior life insurance, often described as graded fatality benefit plans, provides qualified older candidates with marginal whole life insurance coverage without a medical examination.

Latest Posts

Final Expense Care

Whole Life Insurance Final Expense Policy

Final Expense Life Insurance Jobs